800 Views

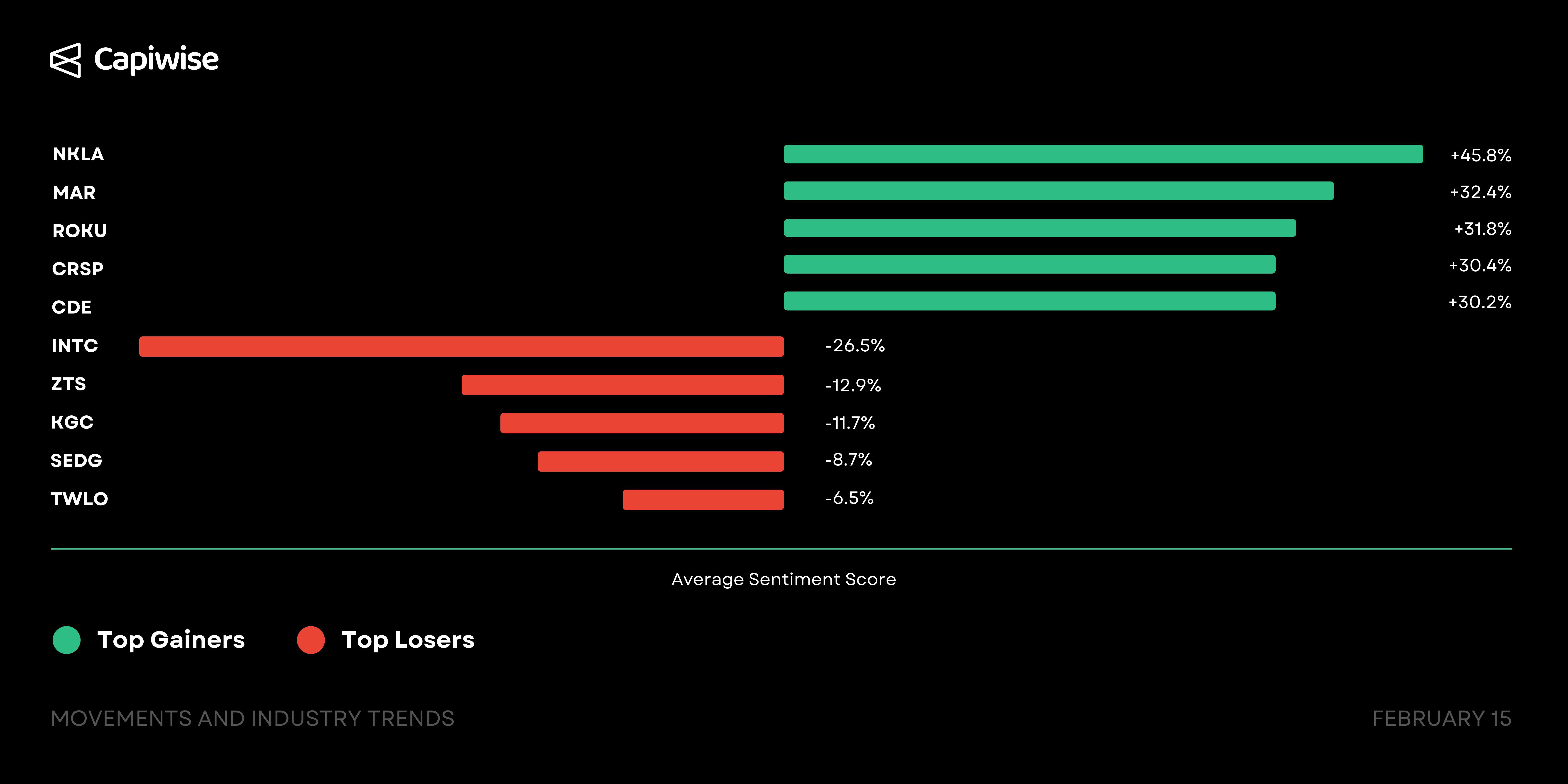

As of February 15, 2025, this report highlights the most significant market movements focusing on the top gainers and losers. Below, we explore key developments, sentiment analysis, broader industry trends, and what it means for investors.

–

–

Top Gainers

–

1. NKLA (Nikola Corporation)

–

Event: Nikola Corporation (NASDAQ:NKLA), a leader in the design and development of zero-emission vehicles, has been identified as a standout stock by prominent market commentator Jim Cramer. In contrast, Mullen Automotive has seen a decline in its stock value after announcing a 1-for-60 reverse stock split.

Impact: Nikola Corporation’s recognition by a well-known financial analyst like Jim Cramer can lead to increased interest from investors and thus potentially influence the stock’s performance positively. Mullen Automotive’s stock drop signifies investor uncertainty following the announcement of their reverse stock split.

Industry Context: The electric vehicle (EV) industry is currently experiencing significant growth due to the global push for sustainable energy alternatives. Both Nikola and Mullen Automotive operate within this industry. Cramer’s endorsement suggests that Nikola may be well-positioned within this competitive market, while Mullen’s stock drop indicates potential challenges.

What this means for investors: The positive sentiment score of +0.458 for Nikola Corporation suggests investor confidence, indicating potential for stock value growth. As an investor, it may be beneficial to monitor Nikola’s performance and consider it for portfolio diversification. However, Mullen Automotive’s recent stock drop may warrant cautious evaluation before investment. It’s essential to understand the implications and risks associated with a reverse stock split, such as potential dilution of share value.

Average Sentiment Score: +45.8%

–

2. MAR (Marriott International)

–

Event: Marriott International (MAR) missed Q1 guidance estimates and highlighted its growing digital strength and loyalty program during its earnings call. Sonder Holdings Inc. (Nasdaq: SOND), a leading global brand of premium design, saw U.S. stock futures fall after a mixed close on Tuesday.

Impact: The miss on guidance estimates led to a drop in Marriott’s stock price. However, the company’s focus on digital strength and a loyalty program may indicate a strategic shift towards enhancing customer retention and engagement. On the other hand, the decline in U.S. stock futures for Sonder Holdings suggests market volatility and potential investor uncertainty.

Industry Context: The events occur in an environment where Federal Reserve Chairman Jerome Powell is addressing Congress, which can affect market sentiment and movements. Meanwhile, the hospitality industry continues to adapt to shifts in consumer behavior and expectations, with an increased focus on digital transformation and customer loyalty.

What this means for investors: These developments could indicate potential short-term volatility for both Marriott and Sonder Holdings. Investors should monitor Marriott’s digital and loyalty program initiatives as they could drive long-term value. Similarly, investors in Sonder should stay abreast of market sentiment and the company’s performance amidst market fluctuations. The average sentiment score of +0.324 suggests a slightly positive outlook, but investors should incorporate a range of factors in their decision-making process.

Average Sentiment Score: +32.4%

–

3. ROKU (Roku, Inc)

–

Event: Analysts have upgraded Roku’s price targets, following a strong Q4 performance and significant growth in its advertising reach. This news comes as the stock market ends on a positive note on Friday, February 14, 2025, with major indexes nearing record highs.

Impact: Roku’s robust Q4 performance and increased advertising reach have led to a rise in its stock price. The sentiment score, an indicator of public opinion towards the stock, also reflects a positive outlook at +0.318. This suggests that investors and market participants are optimistic about the company’s growth prospects.

Industry Context: The rise in Roku’s price targets indicates a broader shift in the media streaming industry. The robust growth in Roku’s advertising reach suggests that the company is successfully capitalizing on the continued trend of cord-cutting, where consumers are increasingly turning to streaming services over traditional cable TV.

What this means for investors: This positive development could present an opportunity for investors. With the company’s strong Q4 performance and increased ad reach, Roku may continue to experience growth, which could potentially lead to further increases in its stock price. However, investors should also consider the risks associated with investing in the streaming industry, including competition and regulatory changes. It is recommended that potential investors conduct further research and consider their risk tolerance before making an investment decision.

Average Sentiment Score: +31.8%

–

4. CRSP (Crispr Therapeutics AG)

–

Event: Investment banking advisory firm Evercore ISI has upgraded the rating of CRISPR Therapeutics (CRSP) from ‘in line’ to ‘outperform’. This change is primarily attributed to the firm’s anticipation of upcoming data.

Impact: The upgrade in rating is expected to positively influence the market perception of CRSP, potentially leading to an increase in stock price. The average sentiment score, a measure of market sentiment towards an asset, is +0.304, indicating a more positive than negative sentiment.

Industry Context: CRISPR Therapeutics operates in the biotechnology industry which is subject to constant change and innovation. The industry is data-driven, meaning that new research, clinical trials, and data can significantly impact a company’s market position. Evercore ISI’s upgrade implies that they expect upcoming data to be favorable for CRSP.

What this means for investors: The upgrade suggests a potentially favorable future performance for CRSP, which may lead to an increase in stock value. However, as with any investment, risk is involved and it is crucial for investors to monitor CRSP’s updates, particularly the upcoming data referred to by Evercore ISI. This could be a good opportunity for investors looking for growth in the biotechnology sector, but they should conduct further research and consider their risk tolerance before investing.

Average Sentiment Score: +30.4%

–

5. CDE (Coeur Mining)

–

Event: Coeur Mining, Inc. (CDE) has completed the acquisition of SilverCrest Metals Inc. This follows amidst a broader market scenario where gold prices are on a record high rally.

Impact: The acquisition could potentially diversify Coeur Mining’s portfolio and increase its exposure to silver, another precious metal. Despite this, CDE doesn’t currently possess the right combination of key factors for a likely upswing.

Industry Context: The acquisition comes at a time when the financial markets are showing an increased interest in asset classes like gold, which have been rallying to record highs. This could suggest a greater market appetite for precious metal commodities, including silver.d can be influenced by various factors including market conditions and changes in company performance.

What this means for investors: The acquisition could potentially enhance the value of Coeur Mining, particularly if the market expands its interest from gold to other precious metals like silver. However, investors should note that CDE currently lacks the optimal combination of key factors for a likely market rise. Hence, while there may be potential for future growth, current investment may carry a degree of risk. It is advisable to closely monitor the commodity market trends and Coeur Mining’s post-acquisition performance before making investment decisions.

Average Sentiment Score: +30.2%

–

Top Losers

1. INTC (Intel)

–

Event: In Q4 2024, Tudor Investment Corp. added Intel Corporation (INTC) to its portfolio, while Renaissance Technologies also initiated a stake in Intel. Meanwhile, Tudor reduced its holdings in Nvidia and exited Bank Renaissance, and Renaissance Technologies discontinued its position in Arm.

Impact: This development could potentially affect the stock prices of these companies. Intel’s stock could see an increase due to the increased demand from these large investment firms. Conversely, Nvidia and Bank Renaissance stocks could experience a decrease in prices due to the sell-off.

Industry Context: The technology sector is going through an evolution, with some companies struggling to keep up with changing times. This explains why some major players, despite their robust market standing, are being hit hard. Consequently, investment firms are reassessing their portfolios to reflect these changes.

What this means for investors: Investors should monitor the performance of Intel closely, as the increased interest from major investment firms could indicate a positive outlook for the company. However, they should also be cautious about the overall volatility in the tech sector and consider diversifying their portfolios to mitigate potential risks. It may also be a good time to consider exiting or reducing positions in companies like Nvidia and Bank Renaissance, following the moves made by Tudor Investment Corp.

Average Sentiment Score: – 26.5%

–

2. ZTS (Zoetis)

–

Event: Zoetis Inc. (NYSE:ZTS) announced its Q4 2024 earnings, meeting expectations but forecasting a weaker outlook for 2025. This led to a drop in the stock price.

Impact: The company’s stock fell despite posting better-than-expected results for the fourth quarter. The weaker-than-expected forecast for 2025 has affected market sentiment, leading to a decrease in stock value. The average sentiment score stands at -0.129, indicating negative market sentiment.

Industry Context: Zoetis operates in a highly competitive market. If the company’s growth slows down, as predicted, it could lose market share to its competitors. The negative outlook for 2025 suggests that the company might face challenges in maintaining its current growth rate, which can impact its overall market position.

What this means for investors: This development calls for caution among investors. With the company’s growth expected to slow down, the stock’s value could potentially decrease further. Investors should closely monitor Zoetis’ performance and the overall market trends before making investment decisions.

Average Sentiment Score: -12.9%

–

3. KGC (Kinross Gold Corp)

–

Event: Kinross Gold Corporation (NYSE:KGC) had a significant year in 2024 with impressive financial performance, which included record free cash flow and improved margins. However, it also had earnings and revenue surprises of -13.04% and 27.77%.

Impact: KGC’s strong 2024 performance led to it being listed among the top 10 stocks to watch on Thursday. The improved margins and record free cash flow indicate a robust financial health of the company, despite the unexpected earnings and revenue figures.

Industry Context: The gold mining industry has been experiencing price volatility due to economic and geopolitical uncertainties. Kinross, with its strong financial performance, appears to have navigated these challenges effectively.

What this means for investors: Kinross’s strong financial indicators suggest it could be an attractive investment opportunity. However, the earnings and revenue surprises imply a degree of unpredictability. Therefore, investors should consider their risk tolerance levels and investment goals before making a commitment. Despite a negative average sentiment score, the company’s robust cash flows and improved margins may offer a counterbalance. Investors are advised to closely watch KGC’s performance and market trends.

Average Sentiment Score: -11.7%

—

4. SEDG (SolarEdge)

–

Event: SolarEdge Technologies (SEDG) recently reported its Q4 results, which showed a weaker than expected top-line performance.

Impact: The poor demand and a drop in market price, with SEDG standing at $14.22, marking a -0.49 reduction, has negatively impacted the company. The average sentiment score is also negative, at -0.087, indicating a pessimistic market sentiment towards the company.

Industry Context: The solar industry is highly competitive and dependent on factors such as government policies, technological advancements, and consumer adoption. The weaker demand for SEDG’s products could reflect broader trends in the industry, including potential market saturation or a slowdown in the adoption of solar technologies.

What this means for investors: The current financial performance and market sentiment towards SEDG indicate increased risk. Investors might need to re-evaluate their investment strategies with SEDG and monitor the company and industry trends closely. However, it’s also essential to consider the company’s long-term fundamentals and the potential growth of the solar energy market.

Average Sentiment Score: -8.7%

—

5. TWLO (Twilio)

–

Event: Twilio (TWLO) released its fourth-quarter results, which didn’t meet the expectations of investors. Despite this, Wall Street firms still defended the communications software.

Impact: The market reaction to Twilio’s underwhelming Q4 results has been negative, as reflected in the Average Sentiment Score of -0.065. This indicates a slightly bearish sentiment towards the stock.

Industry Context: Twilio operates within the highly competitive Software and Technology industry, where rapid growth and innovation are crucial for success. Despite the recent downturn, the Average Brokerage Recommendation for Twilio is equivalent to a Buy, suggesting that experts believe in the company’s long-term growth potential.

What this means for investors: The negative market sentiment might seem concerning, but it’s crucial to take into account the positive long-term outlook provided by brokerage firms. Investors should consider the current situation as a potential buying opportunity, given the expected future growth. However, it’s also important for investors to closely monitor Twilio’s performance to ensure that it aligns with their own investment strategy and risk tolerance.

Average Sentiment Score: -6.5%

–

–