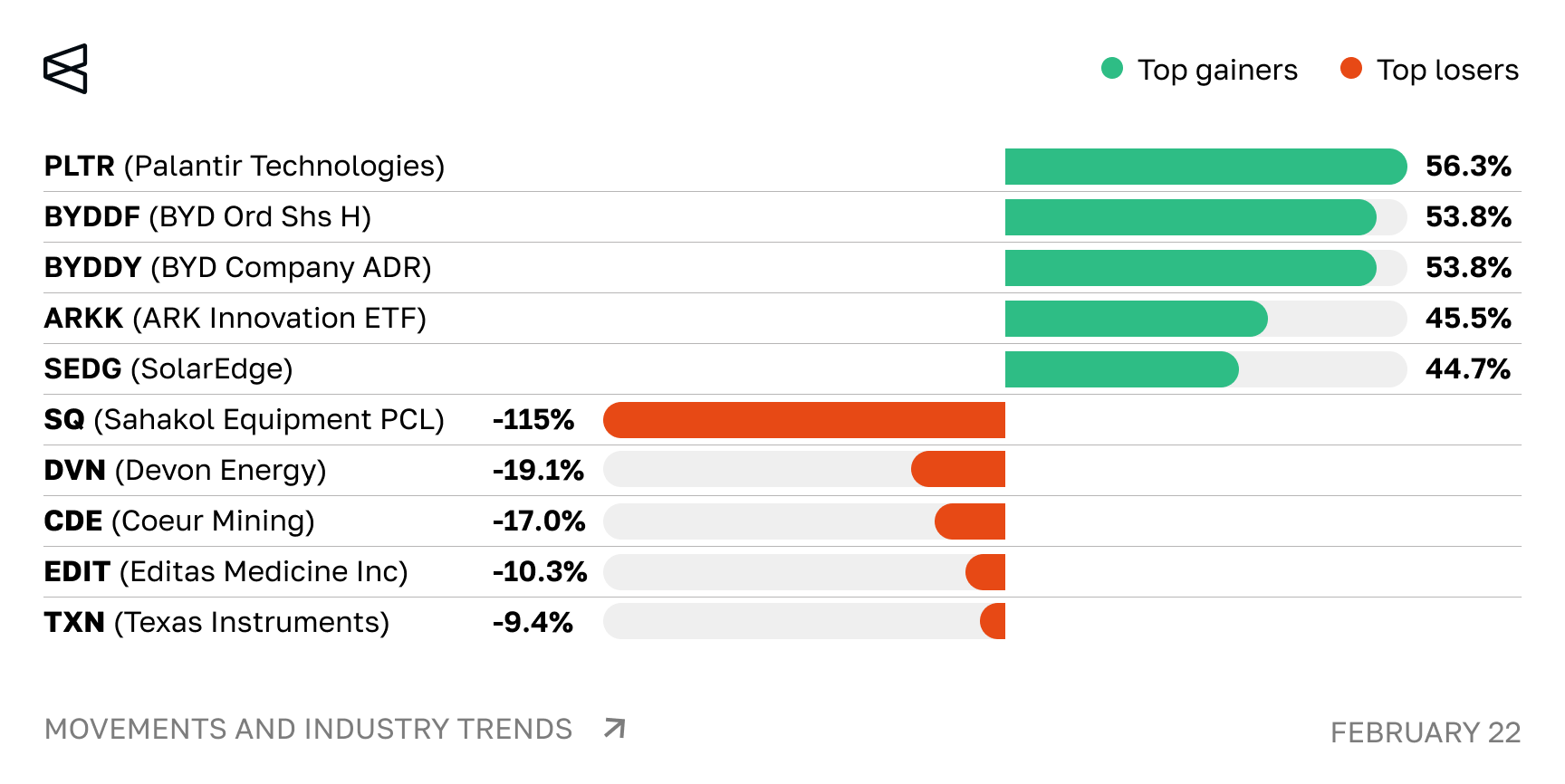

As of February 22, 2025, this report highlights the most significant market movements focusing on the top gainers and losers. Below, we explore key developments, sentiment analysis, broader industry trends, and what it means for investors.

–

–

Top Gainers

–

1. PLTR (Palantir Technologies)

–

- Event: PLTR was featured in a list of 10 AI stocks recommended by analysts.

- Impact: Positive impact on stock sentiment, indicating potential growth in the AI sector.

- Industry Context: Technology stocks have recently seen increased interest from institutional investors.

- What this means for investors: Consider monitoring PLTR and other AI stocks for potential market opportunities.

- Average Sentiment Score: +56.3

–

2. BYDDF (BYD Ord Shs H)

–

- Event: S&P Global expresses optimism about long-term EV market growth.

- Impact: This boosts investor sentiment and potentially drives BYDDF stock prices higher.

- Industry Context: The EV market continues to experience strong growth despite recent slowdowns.

- What this means for investors: Consider long-term investment opportunities in BYDDF as the EV market is expected to remain robust.

- Average Sentiment Score: +53.8%

–

3. BYDDY (BYD Company ADR)

–

- Event: S&P Global expresses optimism about the long-term outlook for the electric vehicle (EV) market.

- Impact: This news boosts investor sentiment towards BYDDY, as the company is a major player in the EV industry.

- Industry Context: The EV market is experiencing a slowdown, but the long-term growth prospects remain positive.

- What this means for investors: Investors should maintain a positive outlook on BYDDY’s long-term growth prospects, despite the current market headwinds.

- Average Sentiment Score: +53.8%

–

4. ARKK (ARK Innovation ETF)

–

- Event: ARKK’s 2024 performance lags behind Nasdaq Composite with an 8.4% return compared to 30%.

- Impact: The underperformance has dampened investor sentiment, reflected in the positive but low average sentiment score (+0.455).

- Industry Context: The broader market saw a significant rally.

- What this means for investors: Consider re-evaluating the portfolio’s allocation to the innovation sector.

- Average Sentiment Score: +45.5%

–

5. SEDG (SolarEdge)

–

- Event: BMO Capital downgrades SolarEdge Technologies to Underperform.

- Impact: The downgrade raises concerns about the company’s growth prospects, leading to a potential sell-off by investors.

- Industry Context: The broader clean energy sector is facing headwinds due to macroeconomic uncertainty and supply chain disruptions.

- What this means for investors: Investors should consider reducing their exposure to SEDG in the near term as the downgrade may weigh on share prices.

- Average Sentiment Score: +44.7%

–

Top Losers

1. SQ (Sahakol Equipment PCL)

–

- Event: Shareholders impacted with significant losses encouraged to contact law firm.

- Impact: Indicates potential legal action, exacerbating negative investor sentiment and potentially leading to further downward pressure on SQ stock.

- Industry Context: Fintech companies face regulatory scrutiny amidst market volatility.

- What this means for investors: Monitor developments for potential impact on SQ’s reputation, legal expenses, and stock performance.

- Average Sentiment Score: -115.0%

–

2. DVN (Devon Energy)

–

- Event: Devon Energy reports mixed results, highlighting operational efficiency gains amidst a volatile commodity outlook.

- Impact: DVN stock may be perceived as a value trap due to limited growth potential and uncertain commodity prices.

- Industry Context: The energy sector faces challenges with fluctuating commodity prices and macroeconomic headwinds.

- What this means for investors: Consider the potential risks associated with DVN’s limited growth prospects and monitor commodity market trends before making investment decisions.

- Average Sentiment Score: -19.1%

–

3. CDE (Coeur Mining)

–

- Event: Coeur Mining (CDE) reports earnings and revenue surprises in Q4 2024, completes SilverCrest transaction.

- Impact: Despite earnings surprise, overall sentiment remains neutral.

- Industry Context: Silver prices have been trending upwards, buoyed by growing industrial demand.

- What this means for investors: Monitor CDE’s performance and broader silver market dynamics for potential trading opportunities.

- Average Sentiment Score: -17.0%

—

4. EDIT (Editas Medicine Inc)

–

- Event: WORK Medical Technology Group LTD (WOK) surged over 94% in Thursday’s pre-market, boosting investor sentiment.

- Impact: WOK’s significant pre-market gain suggests positive market sentiment and potential investor interest in the healthcare technology sector.

- Industry Context: Healthcare technology stocks have been experiencing increased demand due to ongoing advancements in medical devices and digital health solutions.

- What this means for investors: Investors may consider monitoring WOK’s performance and evaluating potential opportunities in the healthcare technology industry.

- Average Sentiment Score: -10.3%

—

5. TXN (Twilio)

–

- Event: Texas Instruments Incorporated (TI) celebrates 25th anniversary.

- Impact: Anniversary celebration has limited impact on stock and investor sentiment, as reflected in a neutral average sentiment score of -0.094.

- Industry Context: Semiconductor industry is experiencing a downturn due to weak demand and supply chain disruptions.

- What this means for investors: Continue monitoring industry trends and company updates for potential investment opportunities.

- Average Sentiment Score: -9.4%

—

FX Market Summary

—

USD/EUR Performance

—

Figure: USD/EUR Over the Last Year.

–

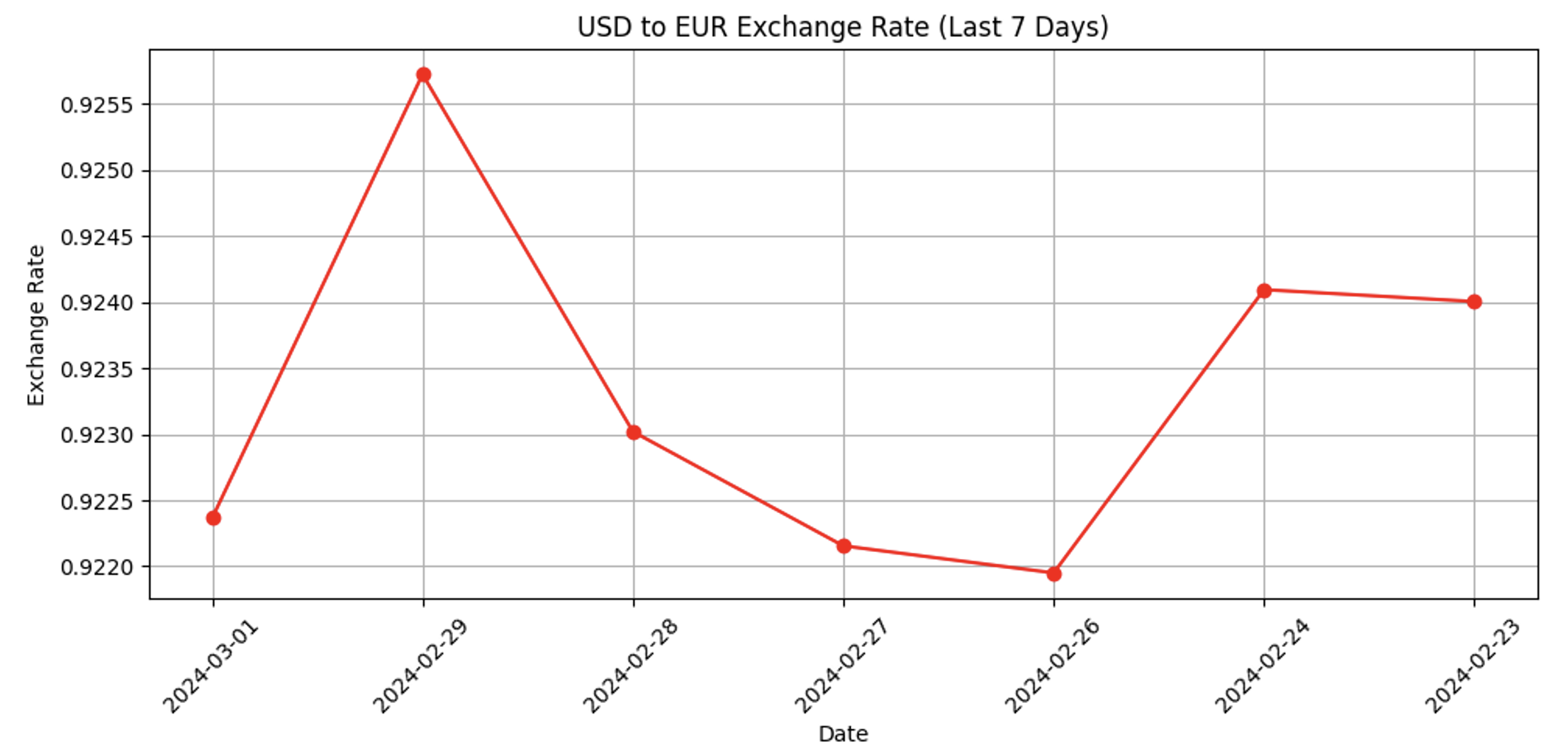

Figure: USD/EUR Exchange Rate (Last 7 Days).

The USD to EUR exchange rate has experienced a moderate decline over the past 7 days, falling from 0.9240 to 0.9134. This trend has been characterized by fluctuations, with short-term recoveries followed by further depreciation. Factors influencing the decline include global economic uncertainty, geopolitical tensions, and central bank policy decisions. The potential implications for investors include reduced profitability for USD investments in the eurozone, increased costs for EUR investments outside the eurozone, and volatility in currency markets.

–

—

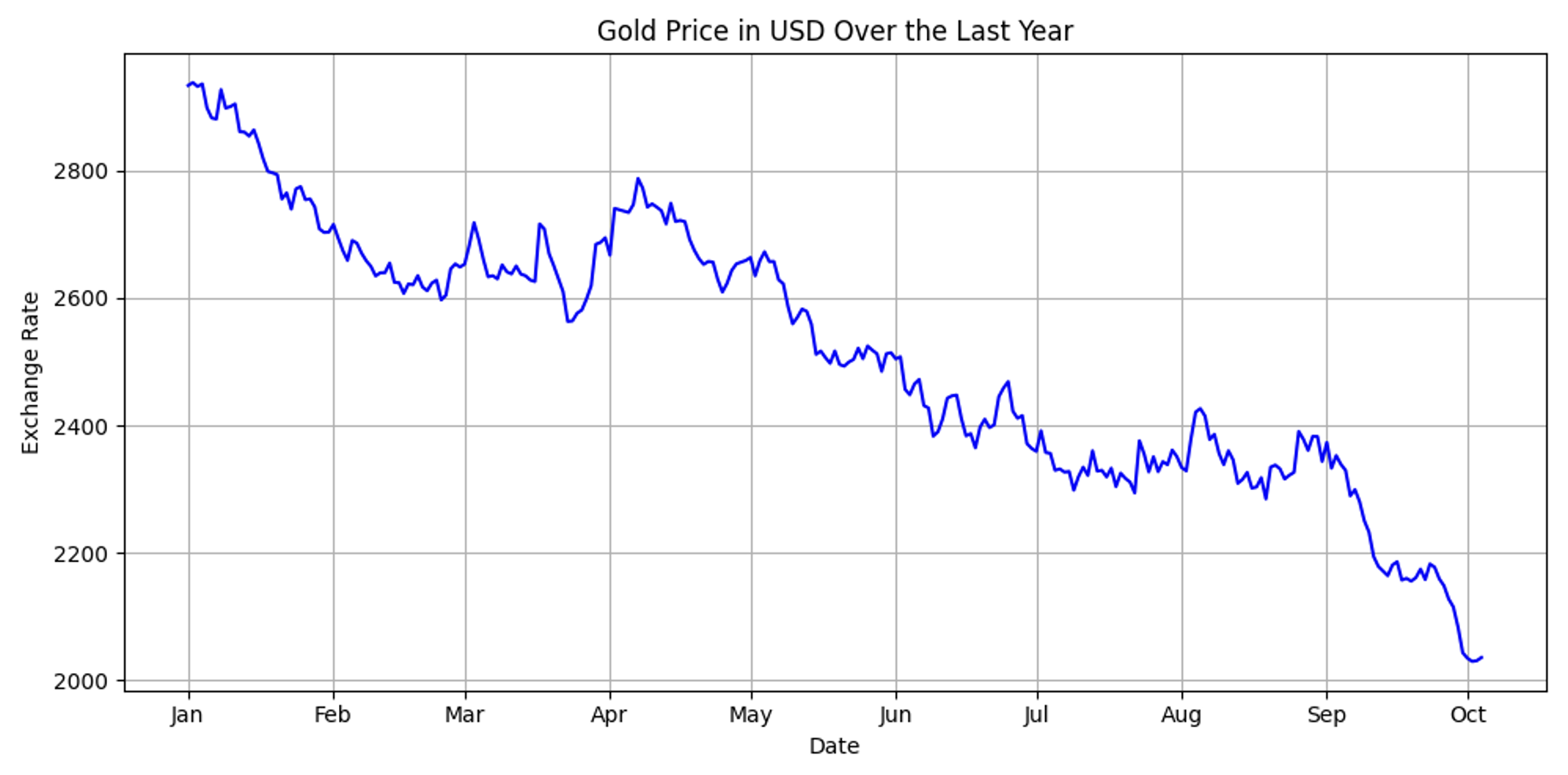

XAU/USD Performance

—

Figure: XAU/USD Over the Last Year.

The USD to EUR exchange rate has been on a significant upward trend since February 2024, with considerable volatility along the way. A combination of factors has contributed to this trend, including rising inflation in the Eurozone, concerns about the European economy’s growth prospects, and the strength of the US dollar due to its status as a safe-haven currency. The trend has implications for investors, as it can impact portfolio returns and currency exchange rates for cross-border investments. Monitoring these factors to understand their impact on the exchange rate is important for investors to make informed decisions.

–

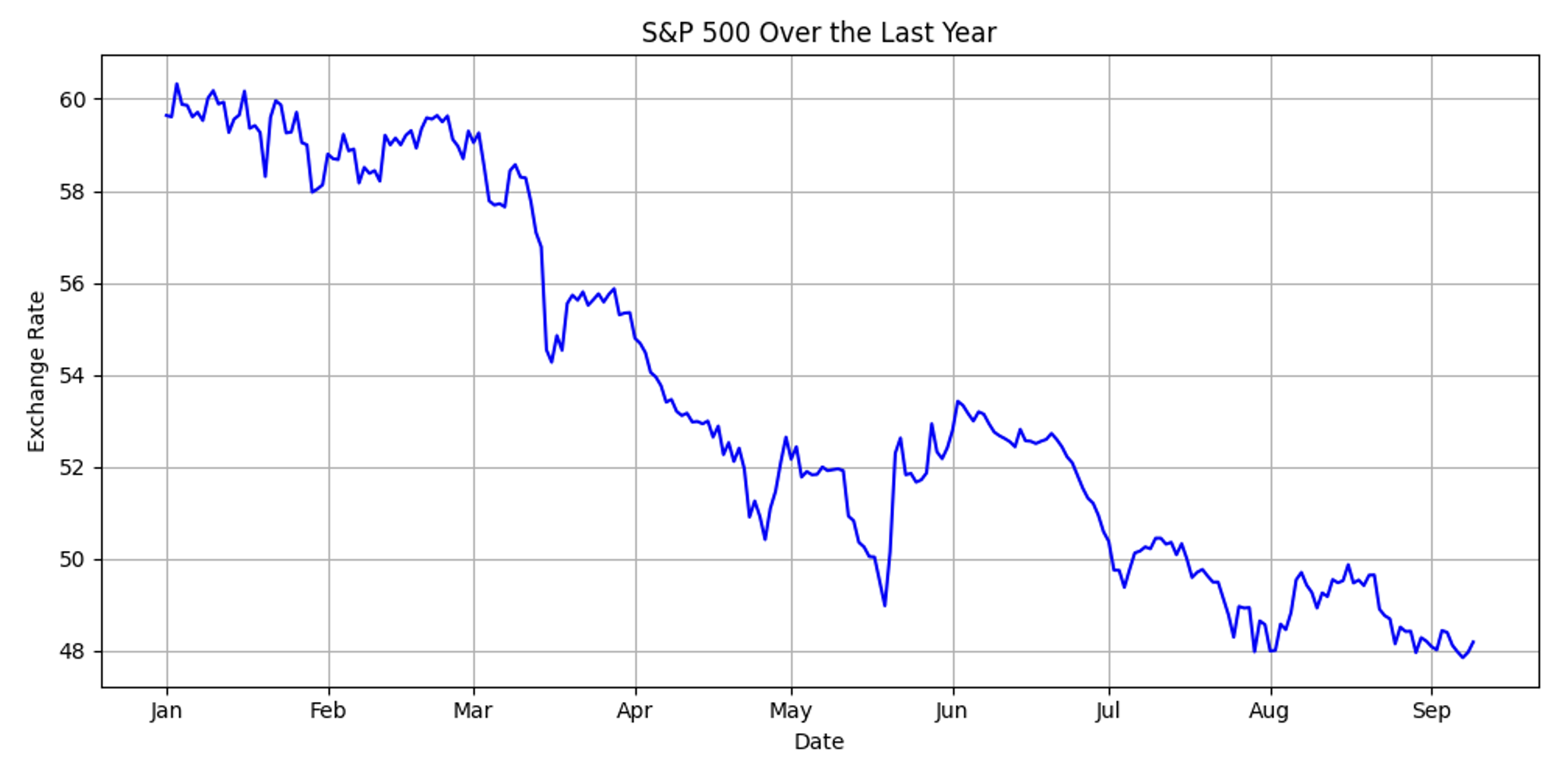

S&P 500 Performance

–

Figure: S&P 500 Over the Last Year.

The USD/EUR exchange rate has fluctuated significantly over the past year, with the euro gaining ground against the US dollar in recent months. The euro’s recent upswing can be attributed to several factors, including the European Central Bank’s (ECB) decision to raise interest rates for the first time in a decade, the ongoing conflict in Ukraine, and the US Federal Reserve’s signaling that it will slow the pace of its rate hikes. The euro’s strength is likely to continue in the near term, as the ECB is expected to further tighten monetary policy, while the war in Ukraine looks set to continue, and the US economy may enter a recession. Investors should carefully monitor the evolving geopolitical and economic landscape to assess the potential impact on the exchange rate’s direction.

–

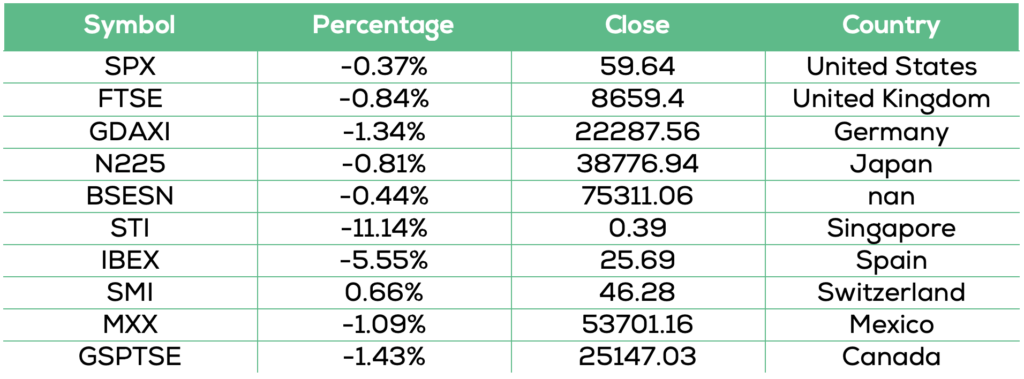

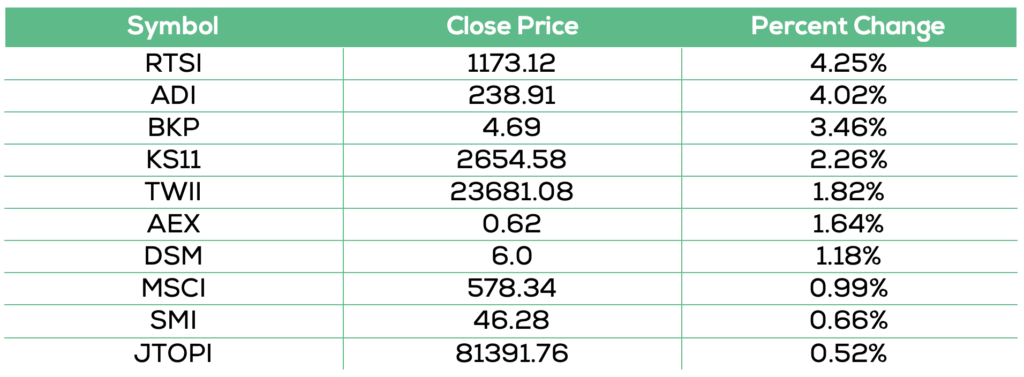

Top 10 Index Gainers

–

–

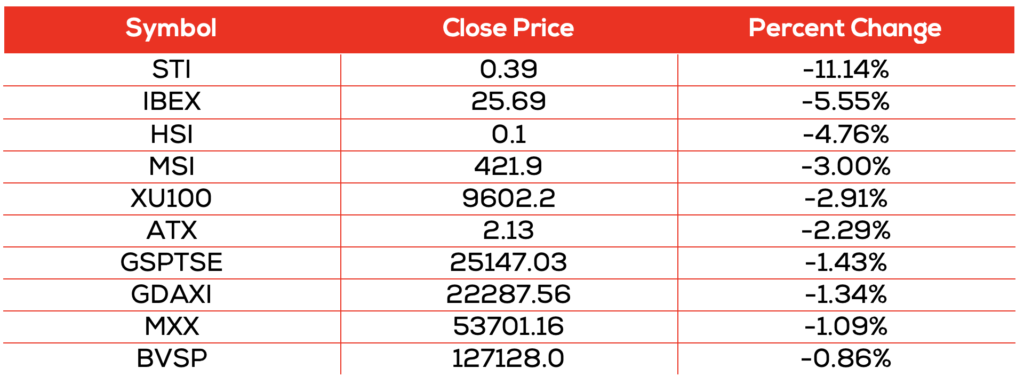

Top 10 Index Losers

–

–

Top 10 Global Indices

–