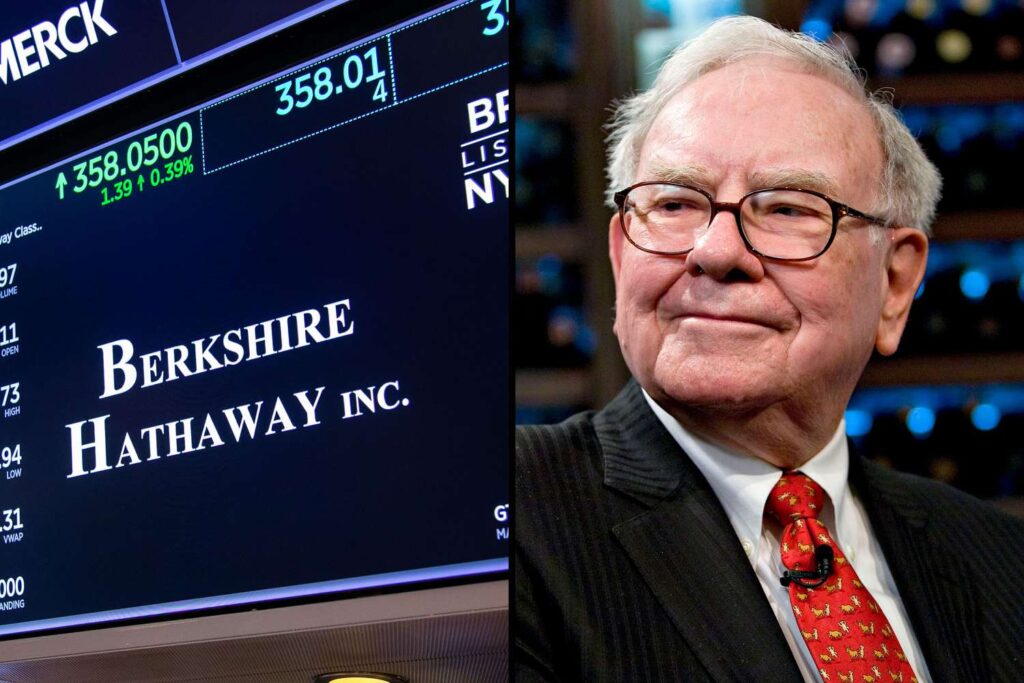

Berkshire Hathaway Inc. (BRK.B), often referred to as a “mutual fund in disguise,” is a unique investment entity that offers the benefits of broad diversification and professional management, all under the legendary leadership of Warren Buffett. But what makes this conglomerate so similar to a mutual fund, and why might it appeal to investors seeking diversification?

A Closer Look at Berkshire’s Asset Allocation

Berkshire Hathaway’s investment portfolio is a complex blend of privately held businesses, publicly traded equities, and substantial cash reserves. Here’s how these components break down:

- Privately Held Operations: Berkshire owns a vast array of companies across various industries, from insurance (GEICO) and energy (Berkshire Hathaway Energy) to manufacturing (Precision Castparts) and retail (Nebraska Furniture Mart). These companies generate consistent cash flow and contribute to Berkshire’s overall stability.

- Publicly Listed Equities: As of the latest figures, Berkshire’s portfolio of publicly traded equities was valued at $267 billion. This portfolio includes major stakes in well-known companies like Apple, Coca-Cola, and Bank of America, among others.

- Cash Reserves: Berkshire is known for maintaining significant cash reserves, currently around $114 billion. These reserves provide a cushion for future investments and acquisitions, as well as a buffer during market downturns.

Implicit Leverage Through Insurance Subsidiaries

One of the unique aspects of Berkshire Hathaway is its implicit leverage through the loss reserves of its insurance subsidiaries. Here’s how this works:

- Insurance Float: The “float” refers to the premiums collected by Berkshire’s insurance companies that have not yet been paid out as claims. This float, which amounts to tens of billions of dollars, is essentially borrowed money that Buffett can invest without having to repay immediately. It acts as a form of leverage, enhancing returns on equity investments.

- Cash and Fixed-Income Holdings: Alongside the insurance float, Berkshire holds substantial fixed-income investments, including Treasury bonds. These holdings provide stability and liquidity to the overall portfolio.

Buffett’s Evolving Investment Strategy

Warren Buffett, known for his value investing approach, has gradually shifted his strategy to focus on acquiring “great companies at reasonable prices” rather than just undervalued assets. This shift reflects Buffett’s recognition that owning high-quality businesses with durable competitive advantages can lead to superior long-term returns.

- From Value to Quality: Buffett’s transition is evident in Berkshire’s large stake in Apple, a company with a strong brand, loyal customer base, and significant pricing power—qualities that Buffett now prioritizes.

- Diversified Portfolio: Berkshire’s equity portfolio, with over 100 positions, offers investors broad exposure across various sectors, mirroring the diversification one might find in a mutual fund.

Berkshire’s Valuation and P/E Ratios

The article examines Berkshire Hathaway’s price-to-earnings (P/E) ratios in comparison to other companies. While P/E ratios provide a snapshot of valuation, it’s important to consider the context:

- Stable Cash Flows, Fluctuating Valuations: Despite fluctuations in market valuations, Berkshire’s investments consistently generate strong cash flows. This consistency is a key factor in the company’s long-term investment appeal.

- P/E Ratio Insights: Berkshire’s P/E ratio may appear lower or higher than other companies, depending on market conditions. However, investors should focus on the underlying quality of Berkshire’s assets and their ability to produce reliable earnings over time.

In Conclusion, Is Berkshire Hathaway Right for You?

Berkshire Hathaway’s structure and strategy make it an intriguing investment, particularly for those seeking diversified exposure with professional management. While the company shares some similarities with a mutual fund, its unique advantages—such as the insurance float and Buffett’s expertise—set it apart.

Ultimately, the decision to invest in Berkshire Hathaway depends on your investment goals and risk tolerance. The company’s diversified portfolio, stable cash flows, and evolving strategy offer a compelling case, but as always, it’s crucial to conduct your own analysis and consider how it fits into your overall investment strategy.