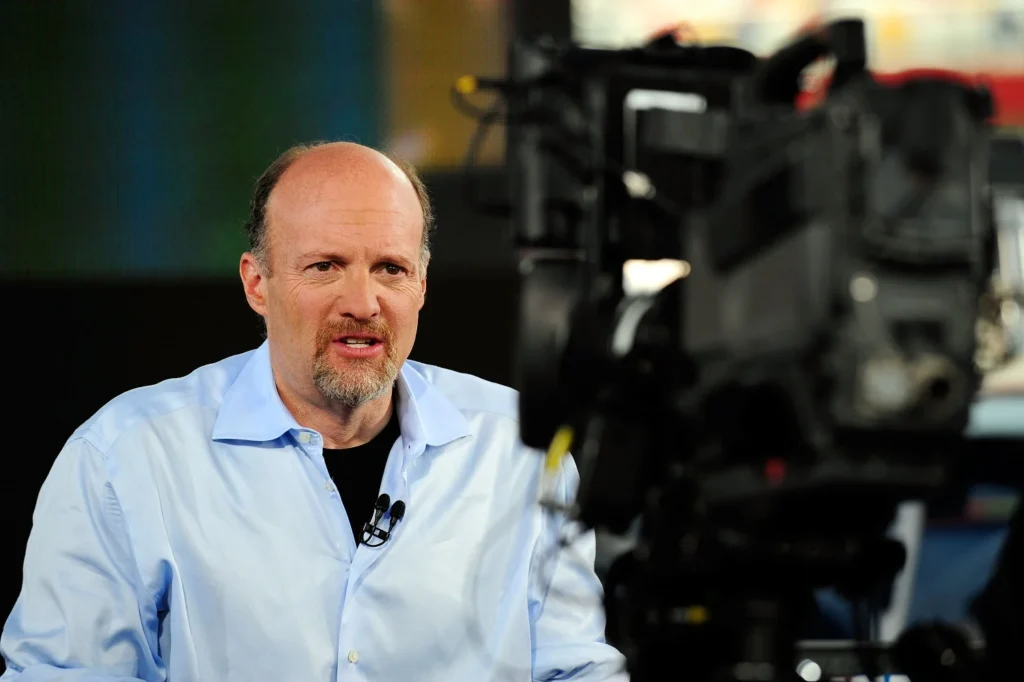

Jim Cramer, the outspoken and energetic host of CNBC’s “Mad Money,” is a prominent figure in the financial media world. Known for his animated stock recommendations and market analysis, Cramer has garnered both a dedicated following and his fair share of critics. On Wall Street, where sharp wit and humor are part of the culture, Cramer has often found himself the subject of jokes and satire. In fact, some investors have gone so far as to create an exchange-traded fund (ETF) designed to profit by betting against his stock picks, a clear indication of the skepticism some hold toward his predictions.

The Charlie Munger Perspective

One of the most memorable critiques of Cramer came from Charlie Munger, the vice-chairman of Berkshire Hathaway and a close partner of Warren Buffett. Munger, renowned for his straightforward and often blunt assessments, once remarked that Cramer “pretended to have useful insights on every subject.” This comment, while humorous, underscores a broader point that Munger and Buffett have made throughout their careers: the complexity of investing and the difficulty of consistently outperforming the market.

Munger’s investment philosophy, often described as the “do less” approach, is rooted in simplicity and focus. He and Buffett have famously concentrated their investments in a few select companies where they have deep knowledge and a competitive edge. This strategy has proven highly effective, resulting in a remarkable 19.8% compounded annual return from 1965 to 2023 for Berkshire Hathaway.

Lessons for Everyday Investors

Munger’s philosophy offers valuable lessons for everyday investors, particularly those who may feel overwhelmed by the vast array of information and opinions in the financial world. Rather than trying to outsmart the market with frequent trades or by following every piece of advice from financial pundits, Munger advocates for a more passive approach. By investing in low-cost index funds, which track the overall market, investors can benefit from the long-term growth of the economy without the stress of constantly managing their portfolios.

This approach aligns with the growing trend toward passive investing, which has gained significant traction in recent years. For the first time in 2024, passive funds—those that aim to replicate the performance of a market index—have surpassed active funds in total assets under management. This shift reflects a broader recognition of the challenges that active fund managers face in consistently beating the market, and the appeal of a more straightforward, cost-effective strategy.

Opportunities in Active Investing

However, it’s important to note that while passive investing has become increasingly popular, there are still opportunities in active investing, particularly in certain market segments. For instance, actively managed bond funds have shown potential for outperformance, especially in complex markets where specialized knowledge and expertise can make a difference. Self-directed investors who possess unique insights or a deep understanding of specific industries may still find success in actively managing a portion of their portfolios.

Final Thoughts

Jim Cramer’s role as a media personality and his sometimes-controversial stock picks have made him a target of Wall Street humor, but his influence on retail investors remains undeniable. Meanwhile, the wisdom of Charlie Munger offers a contrasting approach, emphasizing simplicity, patience, and focus. By embracing these principles, everyday investors can navigate the complexities of the market more effectively, potentially achieving better long-term outcomes.

Ultimately, the key takeaway is that investing doesn’t have to be overly complicated. Whether you follow a passive strategy or selectively engage in active investing, staying informed, maintaining discipline, and understanding your own limitations are essential to building wealth over time.